If the 2023 holiday season is any indication, the retail landscape is undergoing a transformation reflecting the convergence of several key trends that are reshaping consumer behavior and retail strategies. The surge in mobile shopping, coupled with Gen Z entering the landscape, alongside the use of AI, are all emerging as defining catalysts for change, influencing not only the transactional aspect but also the overarching consumer journey.

This shift to mobile shopping was complemented by a broader surge in e-commerce, as shoppers displayed an increased inclination toward online channels. In fact, Thanksgiving Day alone saw consumers spend $5.6 billion, reflecting a 5.5% YoY increase, highlighting another year of online growth. The enthusiasm among shoppers propelled a record-breaking 11 days with daily spending surpassing $4 billion, according to Adobe Analytics, underscoring the sustained momentum throughout the holiday season.

Heavy discounting strategies and the rising popularity of flexible payment options, such as Buy Now, Pay Later (BNPL), also played pivotal roles in altering the dynamics of consumer spending this past holiday season—a sign of emerging trends that may provide important learnings for retailers in the coming year. Below, MERGE delves into what is fueling these trends, offering insights into their implications for retail brands and the broader industry in 2024 and beyond.

Mobile Leads Record-Breaking E-Commerce Spike

The 2023 holiday season brought forth a palpable shift in e-commerce dynamics, with mobile shopping coming out a clear winner and proving once again that it must be central to brand strategies in 2024. Alongside Thanksgiving, Black Friday also surpassed expectations, with a staggering $16.4 billion in U.S. sales and $70.9 billion globally. Additionally, a record-breaking 79% of shopping traffic (both browsing and buying) occurred on mobile devices, contributing to $5.3 billion in U.S. sales, a marked 10.4% rise from 2022.

The mobile triumph continued throughout the holiday season, as smartphones surpassed desktops, securing over 51% of sales, up from 47% the previous year. Some brands, such as Coach, experienced an even more pronounced rise in mobile shopping, as a whopping 72% of sales for the luxury retailer occurred on mobile devices. Notably, Christmas Day saw mobile devices driving 63% of online sales, according to Adobe. The success of mobile shopping was further amplified by personalized SMS and Email marketing strategies, which generated a substantial $1.8 billion in revenue between Thanksgiving and Cyber Monday. Brands leveraging these tactics predictably witnessed success, evidenced in the 58% YoY increase in online revenue during Cyber Week 2023.

As we enter 2024, 87% of marketers have stated that they plan to continue or increase their investment in mobile messaging through channels like SMS, Facebook Messenger, and WhatsApp. Currently, one in five marketers globally use mobile messaging and 10% of marketers say it’s a top driver of ROI. Only 12% plan to invest in mobile for the first time next year. Simply put, having a mobile strategy will be critical to brand success in 2024. Though many retailers are merely testing mobile messaging at the moment, it needs to be a core competency for brands by next holiday season.

AI an Emerging Catalyst to Retail Success

Though this may come as little surprise, AI proved to be a veritable game-changer during the 2023 holiday season, setting the stage for an increased role in years to come. Per Attentive, nearly 50% of brands that were included in their research utilized AI to enhance their SMS and Email campaigns, resulting in higher click-through rates. Moreover, AI-influenced communication accounted for over 218 million text messages, and 10% of all SMS campaigns were created using AI copy-assisted products. Interestingly, 45% of consumers engaged comfortably with AI-powered conversations, yielding a 2.4x higher conversion rate than human-led interactions.

Considering some of these encouraging results, expect to see many brands dive headfirst into AI. According to IDC, the retail industry already ranks second in global AI spending, while an IHL Group study shows that retailers using AI and machine-learning technologies saw a 2.3 times increase in sales growth and a 2.5 times increase in profit growth in 2023, a trend expected to continue into 2024. In short, companies must invest in AI for the future. It enables swift data analysis, faster content creation, more personalized customer experiences, and the ability to optimize campaigns in real-time.

The Gen Z (and Gen Alpha) Impact

Gen Z showed up in a significant way during the 2023 holiday season, establishing itself as an ever-important generation to retailers given their willingness to buy differently, compared to their predecessors. Data from The Harris Poll revealed that Gen Z-ers, along with Millennials, were more inclined toward in-person shopping at malls compared to Gen X-ers and Baby Boomers, who preferred online shopping. Still, social media platforms such as TikTok wielded plenty of influence in purchasing decisions, especially among female Gen Z consumers, who showed a propensity for clothing and beauty products. On the whole, having an overall brand experience (both digitally and in-store) is pivotal for this cohort, and brands will need to consider evolving from last-touch attribution measurement to a more holistic approach.

Social media virality, in general, plays a serious role in the purchasing decisions of younger generations. Per Ellyn Briggs, a brands analyst at Morning Consult, “Roughly half of Gen Z adults (46%) and Millennials (50%) say a product going viral is important to them when considering whether or not to purchase it.” As such, TikTok and other social media platforms not only serve as shopping guides and a form of brand discovery for Gen Z—77% say they are open to purchasing from new brands, the most of any generation—these platforms have become shoppable media channels that will continue to take market share moving forward.

Gen Alpha also appeared for the first time, especially in beauty, but retailers should proceed cautiously when targeting these young buyers; privacy and the lack of guidelines around this audience are top concerns. Influencers will play a pivotal role in reaching Gen Alpha, as 49% of kids trust product recommendations from influencers as much as friends/family. With that, expect influencer marketing, video, and CTV to be strong channels of growth in 2024.

Marketers Lean Into Price Management, Perceived Value

Overall, heavy discounting strategies propelled online sales to reach a record $222.1 billion between November 1 and December 31, a 4.9% YoY increase, according to Adobe Analytics. The holiday season's success was further amplified by consumers' responsiveness to enticing deals, with over 20% of the total spend attributed to Cyber Week promotions, showcasing the strategic importance of offers in driving online sales.

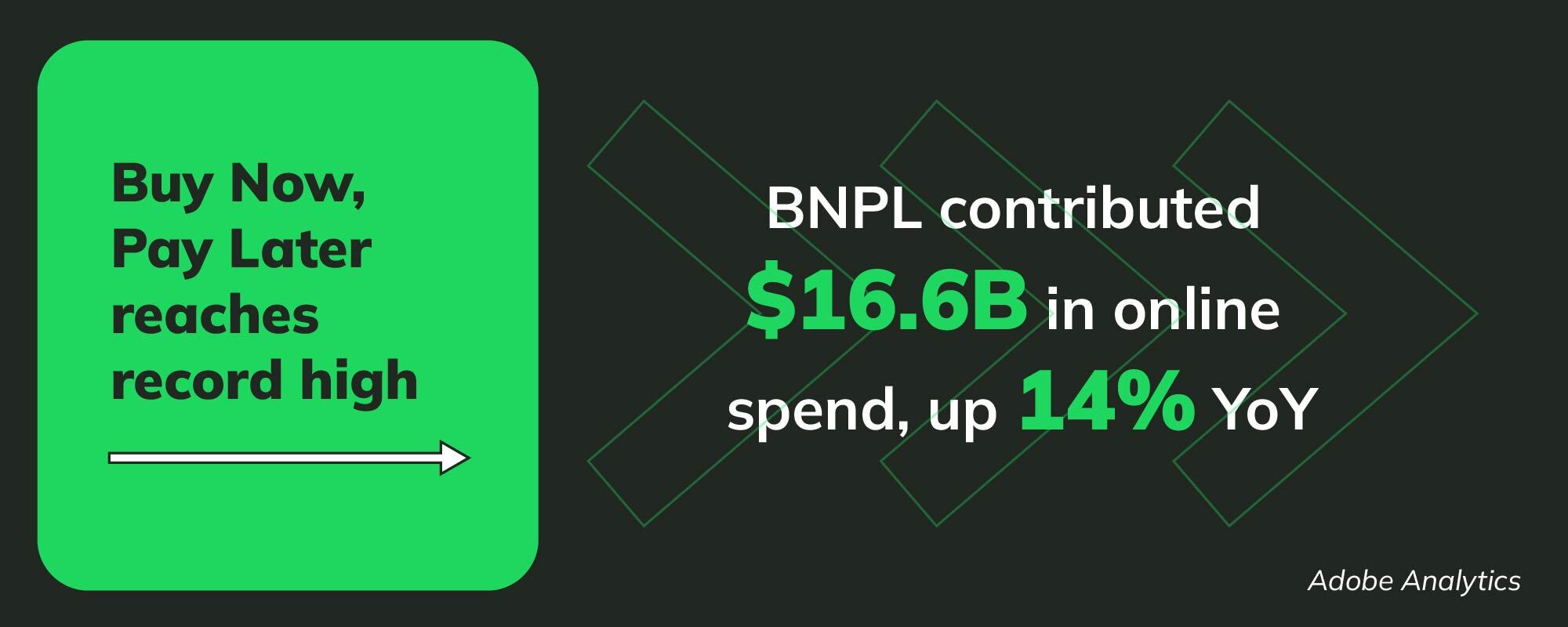

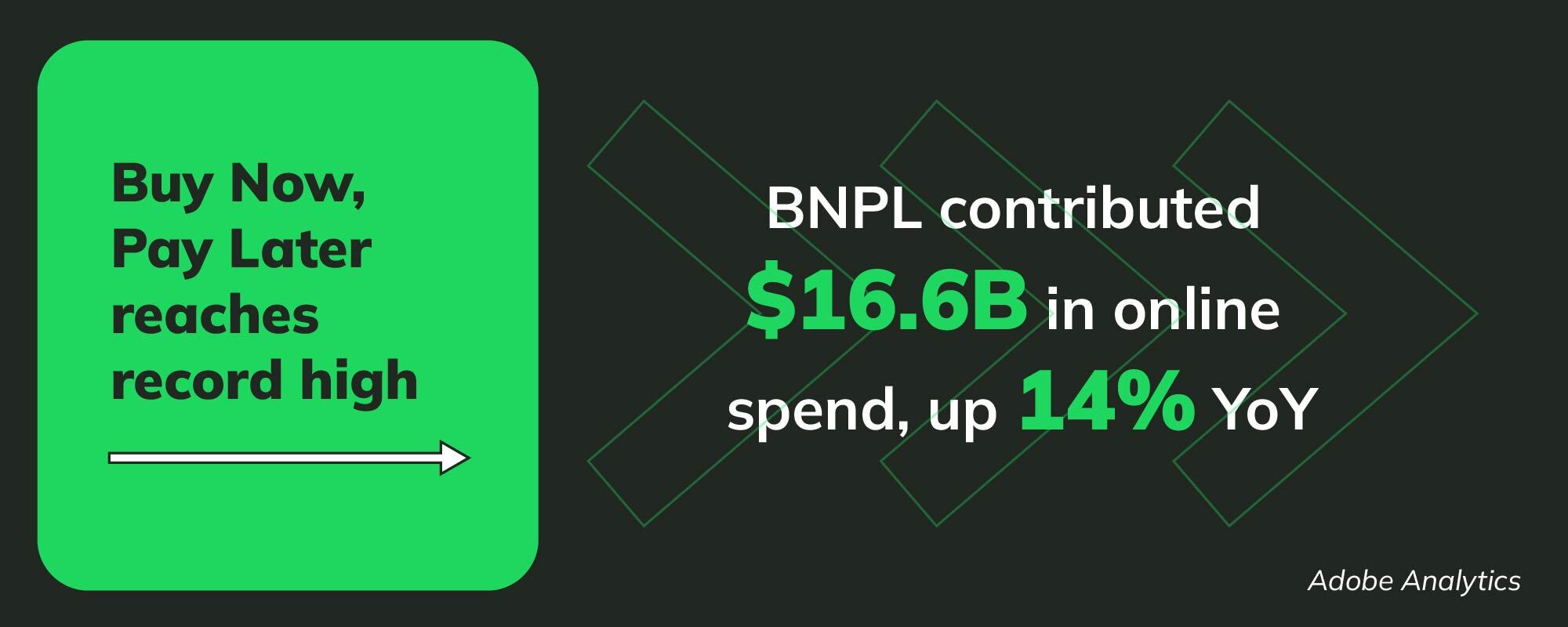

The rising popularity of flexible payment options like Buy Now, Pay Later (BNPL) also played a significant role as a tactic retail brands used to help drive transactions during this period. Thanksgiving Day saw BNPL drive $390 million in online spend, marking an increase of 7.5% YoY, while Cyber Monday witnessed a staggering 42.5% YoY rise, contributing $940 million to online spending. Overall, BNPL reached a record high, contributing $16.6 billion in online spend, up 14% YoY, further demonstrating the evolving dynamics of consumer spending habits.

As inflation continues to impact consumer wallets and own-label products rise in popularity, consumers will continue to seek deals, or at least want to feel that they are getting value for the money they are spending. Instead of providing discounts, many luxury brands are focusing on the premiumization of their brand. The more a brand can elevate the status/drive value of their brand, the less a consumer will perceive a need for a discount.

According to Kantar BrandZ 2023 rankings, 52% of brands reached the top tier in their strategic pricing model, up from 42% in 2020. This indicates that consumers are willing to pay more for perceived higher value. Therefore, in 2024, instead of relying solely on discounting and flexible payment options, marketers should also focus on pricing management to align price and value, further enhancing brand perception and profitability.

*AJ Workman, MERGE EVP, Growth Digital also contributed to this article

Looking to keep your brand’s marketing efforts on the cutting edge? Connect with MERGE's retail experts to help future-proof your efforts today!