Gen Z Spending Behaviors

September 1, 2024

MERGE research highlights the dynamic and influential relationship between live events and the spending behaviors of Generation Z.

Gen Z Confesses to Experience-Driven Overspending

FOMO Fuels the Fun

According to new research from MERGE, Gen Z consumers reveal their spending habits related to events, and spoiler alert—these experiences can drive the notoriously cost-conscious cohort to overspend impulsively.

MERGE conducted a survey of 1,000 Gen Z consumers and recruited seven Gen Z event-goers attending summer concerts, sporting events, and festivals to track their spending habits. The findings revealed critical insights into how this cohort engages with fashion, entertainment, and sporting events. And how brands can show up—the right way.

Keep scrolling to delve into key insights gleaned from the comprehensive survey.

86% Overspend on Events

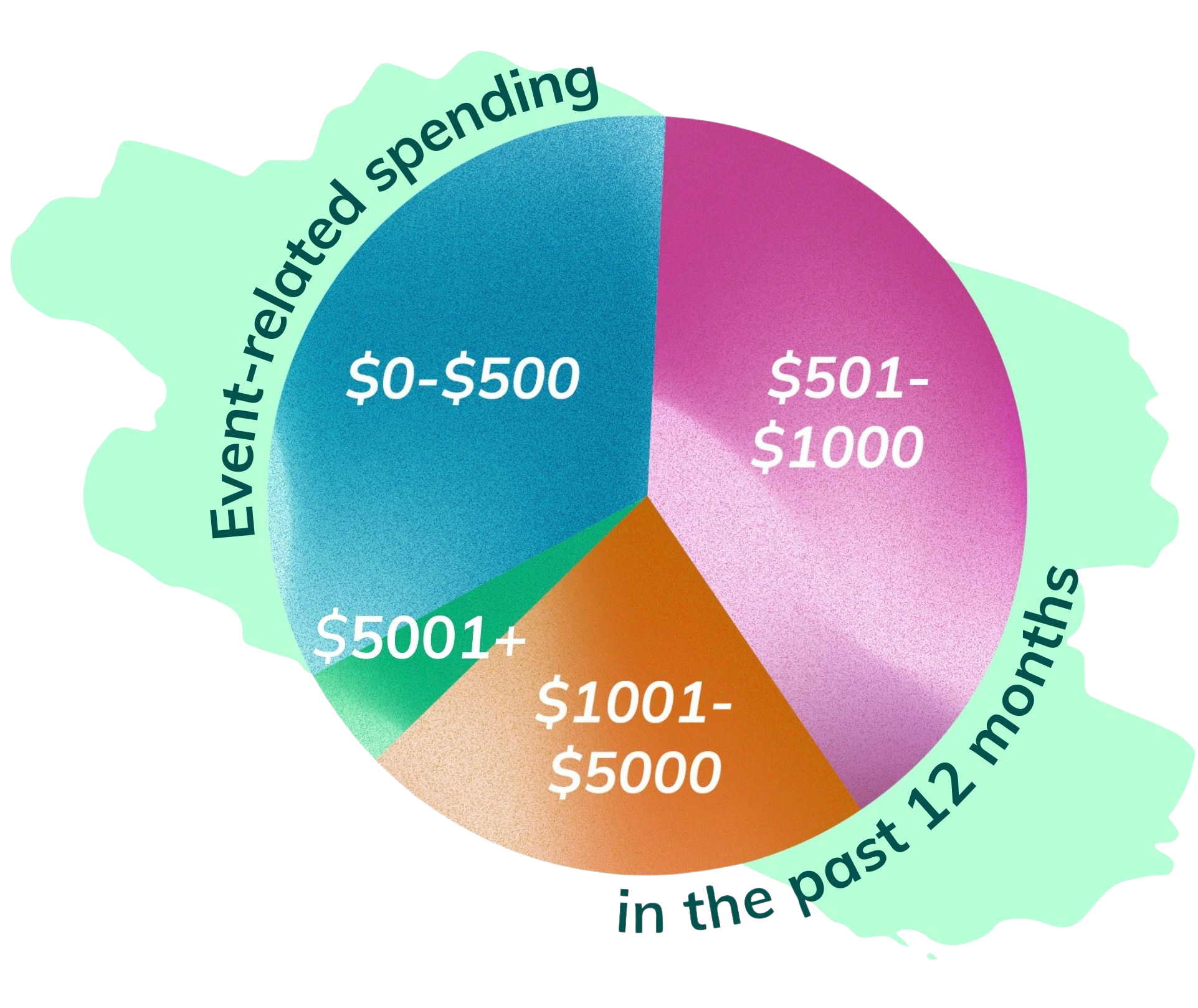

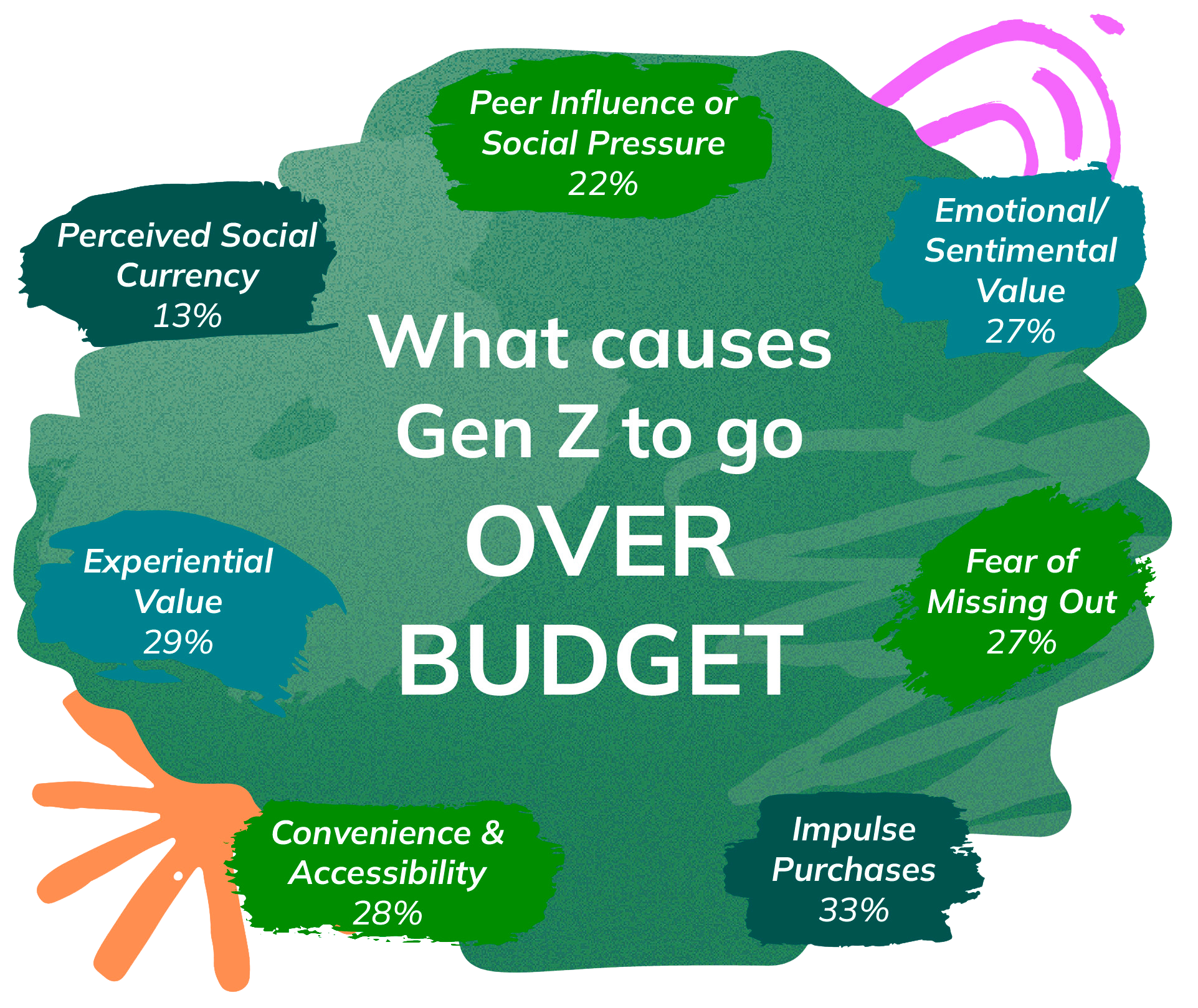

According to the study, just 14% of the 1,000 respondents managed to stick to their budget when attending events. For the remaining 86%, the allure and atmosphere of live events often leads them to overspend.

Top-cited reasons for exceeding budget include impulse purchases like limited-time offers and tempting merchandise, the value of immersive or unique experiences, convenience and accessibility, emotional or sentimental value, and FOMO (fear of missing out).

Authentic Brand Activations Drive Purchase

The top items bought due to event brand exposure include food and beverage (22%) and apparel and accessories (20%). Gen Zs who are frequently influenced by brand collaborations are more likely to attend food fairs and fashion events.

Where do brand placements at events fail? Gen Zs are most bothered by a lack of transparency (26%) and pandering to trends (22%). Surprisingly, sustainability concerns ranked low, however brands must avoid greenwashing practices and "trendjacking" and show up in a mindful way that embraces authenticity and transparency.