Customer loyalty is the foundation of long-term growth for financial service institutions (FSIs). While attracting new customers grabs attention, its loyalty that drives sustainable results through retention, increased engagement, and an expanded share-of-wallet. According to Accenture’s Banking Consumer Study (2025), advocates hold 17% more products with their main bank than non-advocates. But today, loyalty is under pressure. The proliferation of FSIs competing for business and increased customer expectations around experience have made retaining loyal customers more challenging than ever.

Core Challenges in Loyalty

Beyond today’s current challenges, building loyalty in financial services is notoriously difficult. Siloed data limits activation of actionable insights, legacy tech stacks hinder development of personalized experiences, and regulatory constraints add additional complexity. Even in simpler B2C models, these obstacles can result in disjointed customer journeys.

For B2B and B2B2C models, where intermediaries are central to the customer experience, additional challenges emerge. Misaligned messaging between a brand and its intermediaries can dilute the customer experience, while a lack of clarity on complex products and services can limit adoption.

Understanding the needs of all audiences–intermediary and end consumer–and addressing them via optimized customer journeys is critical to overcoming these roadblocks.

Loyalty Across Business Models

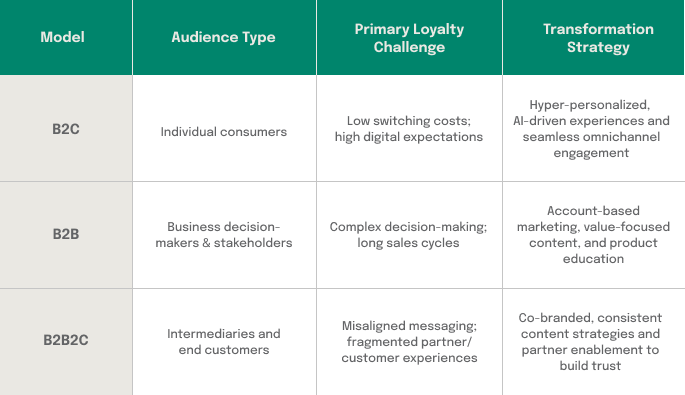

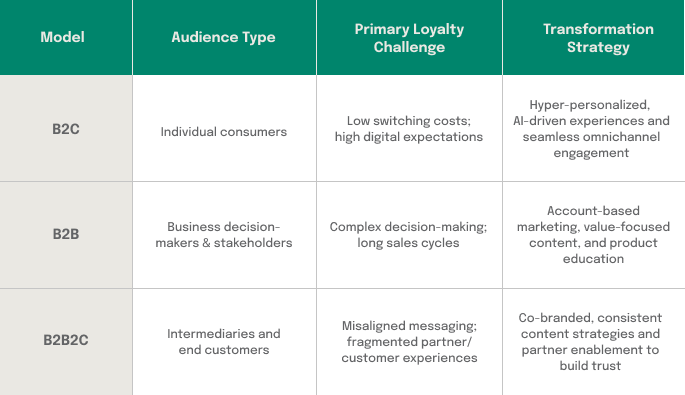

To effectively address the loyalty challenges FSIs face, it's essential to recognize that not all customer models are created equal. Each business model—B2C, B2B, and B2B2C—presents unique audiences, pain points, and strategic needs. Tailoring transformation strategies to these distinct dynamics is key to unlocking sustainable loyalty.

The table below outlines the core differences across models and highlights targeted strategies that help bridge experience gaps and build trust:

Recognizing these distinct challenges enables FSIs to design more intentional, audience-specific customer journeys. Whether you're engaging a direct consumer, a business stakeholder, or working through intermediaries, meeting the right audience with the right experience at the right moment is what drives meaningful engagement and long-term loyalty.

This understanding sets the foundation for the next step: building optimized customer journeys that align content, channels, and technology to support loyalty transformation across every model.

The Role of the Customer Journey

Research is critical to gain intelligence into audience behaviors, pain points, and goals, and the insights derived from research enable us to identify core customer needs and critical moments that matter in the customer journey. This deep audience understanding helps us design journeys that solve core problems our audiences face–precisely when they need support.

Delivering value in those moments requires personalized, compliant, and timely content. A robust content engine, supported by modern technology, enables this by streamlining the planning, creation, and delivery of messaging. By building a connected content supply chain, financial institutions can efficiently scale communications that are both targeted and compliant.

Especially in complex B2B, B2C, and B2B2C environments, the content supply chain empowers institutions to:

- Optimize use of internal (marketing, legal/compliance, SME), agency, and production resources

- Accelerate speed to market

- Maximize the relevant use of content across channels

- Maintain consistency across audiences and channels

- Enable personalization at scale

Beyond operational gains, consistent and relevant messaging strengthens trust. When customers receive communications tailored to their specific needs and context, engagement deepens—and long-term loyalty grows.

Emerging Trends Transforming Customer Journeys

Staying competitive requires adopting emerging trends that are redefining expectations in financial services:

1. AI & Generative Technologies: AI-powered tools—such as assistants and generative content engines—enable real-time, personalized interactions at scale. These technologies reduce resolution times, increase efficiency, and support compliant, tailored communications. However, balancing automation with human empathy remains key to fostering trust and long-term engagement.

2. Omnichannel Experience: Customers increasingly expect seamless transitions between devices and channels, from mobile apps to in-person branches. Institutions using omnichannel frameworks retain more customers. In fact, a study revealed businesses with strong omnichannel strategies retain on average 89% of their customers, compared to much lower rates for companies with weak omni-channel engagement.

3. Zero- and First-Party Data: With privacy concerns increasing, institutions are turning to zero- and first-party data to provide relevant, personalized experiences while reinforcing trust. Consumers are more likely to share data when they feel it’s handled responsibly and transparently, enabling institutions to deliver value without compromising confidentiality.

Why It All Matters

Customer loyalty hinges on creating experiences that are both seamless and adaptable. By investing in tools like the content supply chain, AI, and omnichannel personalization, financial institutions can meet today’s challenges head-on while preparing for future expectations. Together, these strategies close experience gaps, build trust, and deliver long-term customer value.

If your institution is ready to maximize loyalty through smarter B2B, B2C, or B2B2C customer journeys, MERGE’s expertise can help. Contact us today to create tailored strategies that elevate trust and satisfaction at every touchpoint!